You’ve identified a new system that will improve quality. Now, you need to show management a compelling financial ROI and get buy-in. Here’s how to gain support for your proposal.

You’ve identified a new system that will improve quality. Now, you need to show management a compelling financial ROI and convince your colleagues that the new system’s benefits will outweigh the strain and pain of implementation. Here’s how to gain support for your proposal.

Is quality really free? Some manufacturing firms spend 25 percent of their sales dollars fixing design and manufacturing defects. Companies with world-class quality–defect rates as low as one part-per-million–may spend as little as 1 percent remedying defects. If quality isn’t really free, it’s a great bargain!

Why, then, is management sometimes reluctant to approve acquiring systems that can lead to world-class quality? One reason is payout vs. payback. Up-front cost is real, while return on investment is speculative. Another reason may be inadequate knowledge. People with decision-making power are not necessarily expert in statistics, automation or production. Maybe they’re suspicious, disappointed by earlier strategies and technologies that fell short of expectations.

Some people simply resist change. Why inflict something different on those who are content with what is familiar? Well, here’s why. Nearly 70 percent of part defects originate in design. About 30 percent of defects remain subject to production process control. If world-class quality is your objective, you must become able to detect inherent flaws and to control the process. Because quality begins with design and flows all the way through to shipment, it is necessary to involve people at many levels.

So, those intending to champion a new system that will cost money and change accustomed practices must present a convincing case to management and the corporate bean counters, as well as the people operating the new system and everyone using the information it generates.

Scope magnifies the challenge. A quality system that focuses only on one set of machine tools may be relatively easy to “sell” and implement. Compare this with an enterprisewide system operating in multiple areas of multiple plants and generating an information cross-flow bridging boundaries of geography, personal responsibilities and objectives. A quality system of this scope will have a network of stakeholders stretching from machine operators and supervisors to quality directors, cost analysts, the corporate information technology staff and those toiling in the executive suite.

In business, as on the battlefield, success derives from correct strategies and tactics. Strategies call for understanding what motivates adversaries and allies. Tactics employ this knowledge to create winning plans and build a supportive consensus.

The following example shows how to document a case for management approval and peer support. The example used in this article is an advanced enterprisewide statistical process control and automated data-collection system.

First step: Select an application. You may see many excellent applications for a new SPC/ADC system. Select one or a combination of applications that will appeal strongly to your audiences. Does your selection promise a significant, positive financial impact? Will its benefits dovetail with other corporate initiatives? You’re likely to do best at detailing, costing, explaining, defending and implementing processes you are familiar with. Success with an initial application will open the doors for approval of other initiatives.

Next, design the solution. Begin by carefully defining the problem, then completely describe the proposed operational and technical solution to the problem. Remember, you are trying to change your organization, especially the way people work and the way they think. Specify cost savings, especially as they relate to process or change factors, even if these savings won’t be immediate. Point to the beneficial effects on people, productivity and quality. Anticipate objections and address them up-front; those that arise later will be more difficult to counter.

Document all your assumptions. As you research your numbers and document their origin, you build a defense against challenges and increase confidence in the results that your model predicts.

Enlist highly regarded people from other functional areas who can help identify key issues and lend credibility to your arguments. You may need support from finance, management information systems or IT, research, business planning and analysis, human resources and administration, as well as from operations. Gather to your side people who can refine your mission, goals, numbers, issues, problems and assumptions. Give them ownership in the project. This will stimulate them to assure the project’s success because its outcome will reflect on them.

Estimate the project’s cost. Be realistic and be comprehensive. In addition to hardware and software costs, include costs for anticipated equipment upgrades, spares, service contracts, interfaces, initial training, internal resources, internal labor, implementation, integration and outside consulting.

Find out what book values your company puts on employees and other internal resources. Estimate the labor, skill levels and other resources you’ll need. This will help you solidify your model, plot a proper timeline and establish expectations for participation by your enlisted experts and others.

General pleas for interdepartmental assistance usually don’t work. So, be specific. A request stating “I need Bob Peters for two hours the second week of October to configure the hub for our SPC/ADC project” is more likely to gain support because it shows you’ve thought things through.

Analyze the financial aspects. Your company’s goal is productivity. Quality is requisite to productivity. But management is likely to focus first on the anticipated financial ROI, i.e., cost savings and income improvements. So, paint the big picture, structure the outline, and then detail it. Here’s what you need to create:

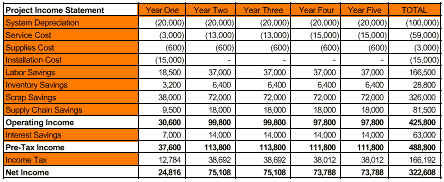

Figure 1: Project Income Statement

Project income statement

This looks forward–typically five years–at assumptions affecting income for your company (or subsidiary, division or department). Figure 1 shows these assumptions.

The income statement follows an accrual process; that is, each anticipated expense is recorded in the period when it will be incurred. There are no secret methods involved here, simply carefully detailed research.

Assumptions affecting this income statement include:

Depreciation. Ask your finance team member about an acceptable depreciation model for your project. Are installation costs depreciated? Which one-time costs should be specified? Figure 1 assumes a straight-line depreciation schedule.

Service cost. This example reflects a hardware and software service agreement with the system vendor, plus an internal $3,000 per year budget for site-specific support issues. The five-year display assumes that the vendor underwrites year one service costs; years two and three are at 10 percent of the initial system cost; years four and five are at 12 percent.

Supplies cost. This is the estimated cost of consumable resources and miscellaneous, nonitemized costs.

Installation cost. This example depreciates all initial installation costs in year one. Some companies choose to bundle installation costs into a system’s purchase price and depreciate the total over a longer period. Check with your finance team member.

Labor savings. Ask all team members for input. In this example, labor savings includes anticipated reductions in inventory management, scrap processing, returned goods processing, paperwork and production time required to meet output schedules.

Inventory savings. This reflects estimated direct savings in material, work-in-process and finished goods inventory gained from improved production efficiencies and yield rates.

Scrap savings. The example assumes modest improvements. Scrap savings can be huge for companies that achieve double-digit reductions from advanced SPC/ADC systems.

Supply chain savings. The new SPC/ADC system should help control the quality of goods entering your processes. This forces the defect costs back to their sources and can be a major source of savings. Figure 1 shows an extremely conservative 25 percent reduction in scrap value.

Operating income. These are accruals of all items except cost-of-money and taxes.

Interest savings. These result from reduced credit balances due to improved inventory efficiency resulting from the project.

Pre-tax income. This is how much all system-related cost reductions add to income.

Income tax. An additional tax results from additional earnings. The example assumes a 34-percent tax rate.

Net income. The total net gain that should result from successful implementation of your new SPC/ADC system.

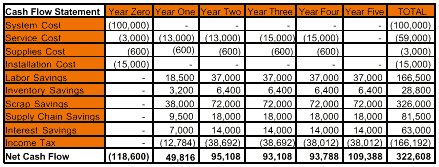

Figure 2: Project Cash Flow Statement

Project cash flow statement

Figure 2 shows what costs will be incurred and when. The year zero column shows immediate costs. The assumptions are similar to those in Figure 1, except for:

System cost. We assume the system vendor wants payment up-front.

Net cash flow. This is what is gained year-by-year. (Remember that in this statement, cash outflows, i.e. costs, are negative numbers and are shown in parentheses.)

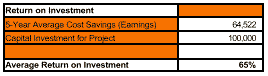

Figure 3: Return on Investment

ROI

As shown in Figure 3, ROI is average yearly income as a percentage of the project’s cost. This is a “cut to the chase” benchmark favored in boardrooms. Find out your organization’s ROI goal. Often, it’s about 25 percent.

Assumptions for this example are:

Five-year average cost savings. The average after-tax saving ($322,608 ÷ 5 years = $64,522) is the same as average net income.

Capital investment. This example uses the system’s purchase price. Some companies choose to include related capital expenses. Check with your financial team member.

Average return on investment. This is simply the five-year average ($64,522) as a percent of capital investment ($100,000), which rounds to 65 percent.

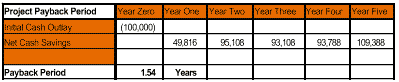

Figure 4: Project Payback Period

Project payback period

As shown in Figure 4, this tells how long it should take to recoup the project’s initial cash investment.

Assumptions include:

Initial cash outlay. In this example, it’s defined as system cost (per Figure 2).

Net cash savings. The same as net cash flow (per Figure 2).

Payback period. Because of a higher rate of net cash savings in year two, the initial cost of $100,000 can be recouped in just over 18 months (1.54 years).

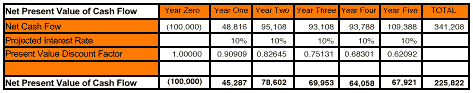

Figure 5: Net present value of cash flow

Net present value of cash flow

Figure 5 displays today’s value of cumulative future cash flows based on current interest/discount rates. Ask your financial team member whether your company has a model for this type of calculation and which formulas to use. NPV implies what can be lost if your new SPC/ADC system is not implemented.

Assumptions include:

Net cash flow. This comes from your cash flow statement (Figure 2).

Projected interest rate. The example uses a simple 10-percent interest rate for loans. Your company may have its own cost-of-money model; this might also be its required rate of return for a capital project.

Present value discount factor. This shows what future cash flows can save instead of cost. Ask your financial team member to help with this calculation.

Net present value of cash flow. For the simplest approximation, apply the straight cash discount rate to each year’s cash flow and add them up. This bottom line suggests how shareholder equity can improve as a result of your project.

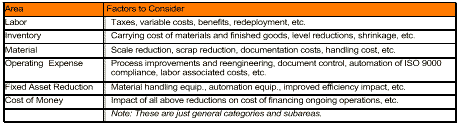

Figure 6: Quantifiable Benefits

Now, quantify the savings

You and your team members who are most familiar with production and quality assurance must analyze the kinds of quantifiable savings (“hard” benefits) and intuitive savings (“soft” benefits) your proposed SPC/ADC system can deliver. Your arguments should be dramatic and convincing. In describing the need for the new system, be factual, thorough and conservative. Figure 6 lists some hard benefits that should be relatively easy to quantify.

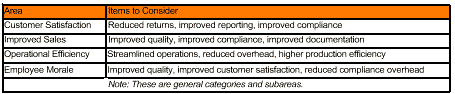

Figure 7: Intuitive Benefits

Figure 7 lists some soft benefits

Everyone may agree they are desirable but may disagree about their respective values. Keep your supporting arguments simple and noncontroversial. In some instances, it may be enough to identify benefits and discuss them briefly. Get outside validation for any definite claims you want to make.

Finally, write the proposal. Here’s how to proceed:

Know your audiences. The MIS or IT director, the floor supervisor, the board of directors and others whose support you seek have different interests. Avoid drafting a generic proposal and simply retitling it for each audience. Instead, list the key factors each audience will look for and focus on those. Minimize discussions of extraneous issues. Talk with other managers at your level–perhaps they can provide you with proposals that have worked for them. But make your proposal reflect your objectives. Be willing to explain and defend your proposal to anyone who steps forward. You will learn from this, and it will make you more confident.

Describe the implementation. This section separates action from financial analysis. Include levels of detail suitable for each audience–enough to prove your forethought and planning without smothering the reader’s interest. Providing for contingencies and projected costs of possible complications in your implementation plan can prove that you are prepared to do whatever it takes to make your project succeed. Show that you have planned well and will be able to execute the plan. Later, use this section to benchmark your progress.

Draft the bulk of your proposal. Start by defining the document, its audience(s) and what you expect to achieve. Then describe the project, its proposed costs and its benefits. Finally, summarize how your proposal has delivered what you outlined at the start. Ask your project team members to review your work for accuracy, clarity and purpose.

Build the supporting documents. These should develop your arguments and detail how you reached your conclusions. Relatively few people may read these documents thoroughly, but those who do can be important to you. Supporting documents should include:

- Financials. Base them on your company’s accounting rules. Have your financial team member verify them. Financial analysts focus on details. Be sure you satisfy them.

- Project plan. While a basic cost justification may not require a project plan, it will be needed if it involves funding by other departments or commitment to the process. You need to develop a project plan in order to appreciate the relationships between tasks, activities and resources. Ask other successful project leaders in your company to advise you about how much detail to present in your cost-justification proposal.

- Assumptions. Compile all assumptions made while developing your documentation. Include the sources for facts, statistics or rules of calculation. This can be highly valuable for defending your plan and resolving disagreements or misunderstandings.

- Execute. Gaining approval for a capital project like a new SPC/ADC system requires demonstrating significant productivity gains and cost savings. These issues make your proposal important to management. Your proposal sets expectations and the tone for your project. Everything hinges on its acceptance. If the new system is really important to your company, then it’s worth the time and care it will take to prepare a factual, convincing, bulletproof proposal.

About DataNet Quality Systems

DataNet Quality Systems empowers manufacturers to improve products, processes, and profitability through real-time statistical software solutions. The company’s vision is to deliver trusted and capable technology solutions that allow manufacturers to create the highest quality product for the lowest possible cost. DataNet’s flagship product, WinSPC, provides statistical decision-making at the point of production and delivers real-time, actionable information to where it is needed most. With over 2500 customers worldwide and distributors across the globe, DataNet is dedicated to delivering a high level of customer service and support, shop-floor expertise, and training in the areas of Continuous Improvement, Six Sigma, and Lean Manufacturing services.